The share prices of listed software companies have fallen sharply this week as investors fear the impact of competition from AI on pricing and margins. Many software companies in private equity portfolios are already building and selling their own AI solutions, but they’re not a large part of revenues… yet. This presents a new equity story challenge and opportunity for PE-owned software businesses preparing for exits.

What’s Happening?

Software and data analytics company share prices have fallen very sharply this week following Anthropic’s launch of a new AI tool for in-house legal teams. This announcement increased investor fears about the incursion of AI into SaaS revenues and margins.

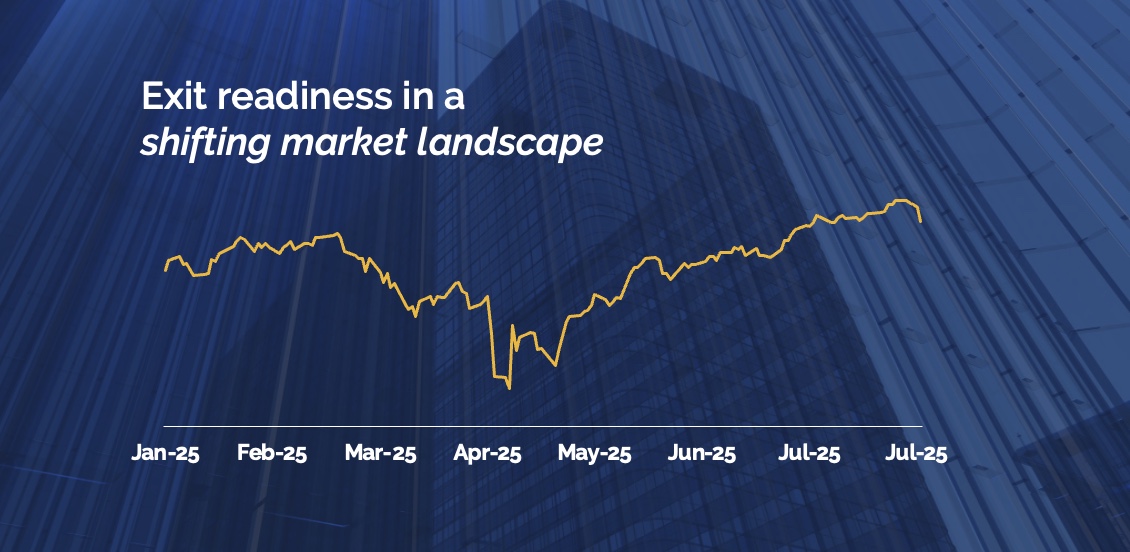

Stock market moves included single day declines of 16% for Thomson Reuters and 13% for the London Stock Exchange – the sort of price declines normally reserved for profit warnings. Listed private capital managers also saw big share price declines, as investors started to worry about the read across for their Technology-heavy private equity and credit portfolios.

At the same time some AI-focused shares, like chipmaker AMD, also fell sharply as the growth outlook struggles to keep up with very high expectations. Uncertainty over the scale and speed of AI-led disruption continues to mean volatility for multiples in Technology stocks.

Why should PE investors care? And what should they do?

Although prone to overreactions, listed markets provide important early signals for investor sentiment across the capital markets. We’d expect any sustained de-rating in listed SaaS shares to have a lasting negative impact on exit multiples for PE-owned technology companies. Contrary to the top-down assumptions of the listed markets, lots of software businesses in the PE-space have been building and buying their own AI solutions. But with their sales and EBITDA breakdown still dominated by their legacy business mix, these companies may find it challenging to convince prospective buyers that they are positioned for future success.

The competitive environment for software is clearly changing very fast. PE-backed software companies need equity stories which show that they are changing with it, even if their AI-product revenues are still nascent today.