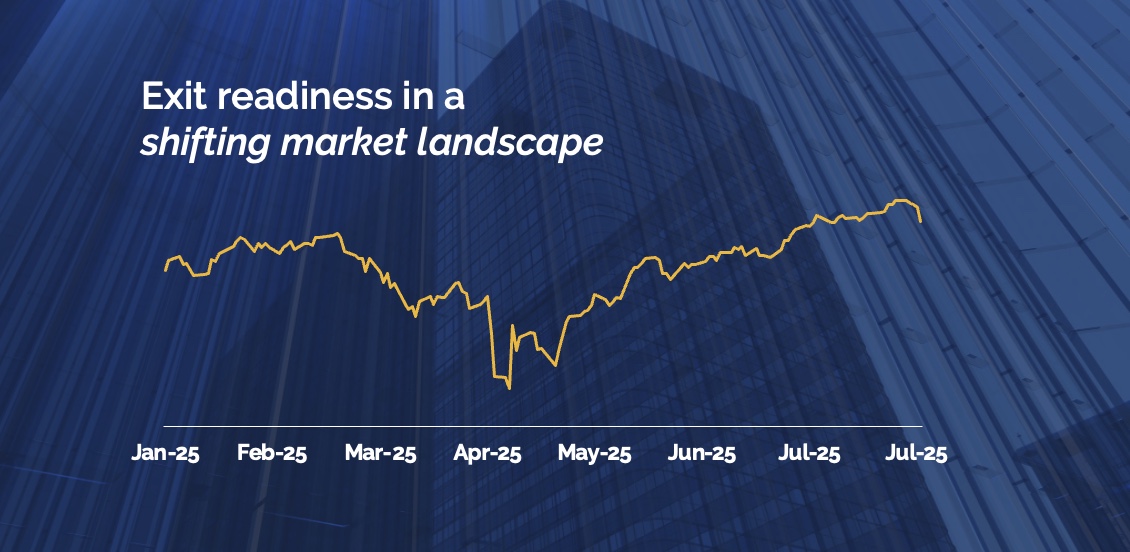

Amid the ESG backlash, this is probably the most common question we get from clients today. This issue is close to the top of the agenda for management and IR teams, in both investment funds and corporates across private and public markets.

The situation is moving very quickly, creating uncertainty for companies and investors. The gap between expectations in the US & Europe has widened to a point where it’s increasingly difficult to reconcile the two.

New SEC guidance has created sufficient uncertainty that, this week, the FT reports that Blackrock has temporarily paused meetings with some companies while it assesses the implications.

Why has the world’s biggest asset manager stopped meeting with (some) companies it owns?

In simple terms, this new regulatory guidance brings additional disclosure requirements into scope for investors who are deemed to “exert pressure” on management. This definition has been widened to include shareholders discussing with issuers their preference for certain ESG policies at a corporate level.

In even simpler terms, large passive investors are now being treated like activists. Needless to say, the passive equity management business model – very high AUM & very low fees – is not designed to cover the costs associated with being classed an “activist” in every stock they own.

Companies and investors across public and private markets have implemented ESG policies based on one set of rules. But they are fast changing. As ESG investment & operational strategies are rapidly adapted in response, financial communication strategies need to do the same.