A clear and compelling equity story can help buyout-owned companies get exit ready and deliver a successful sales process at an attractive valuation.

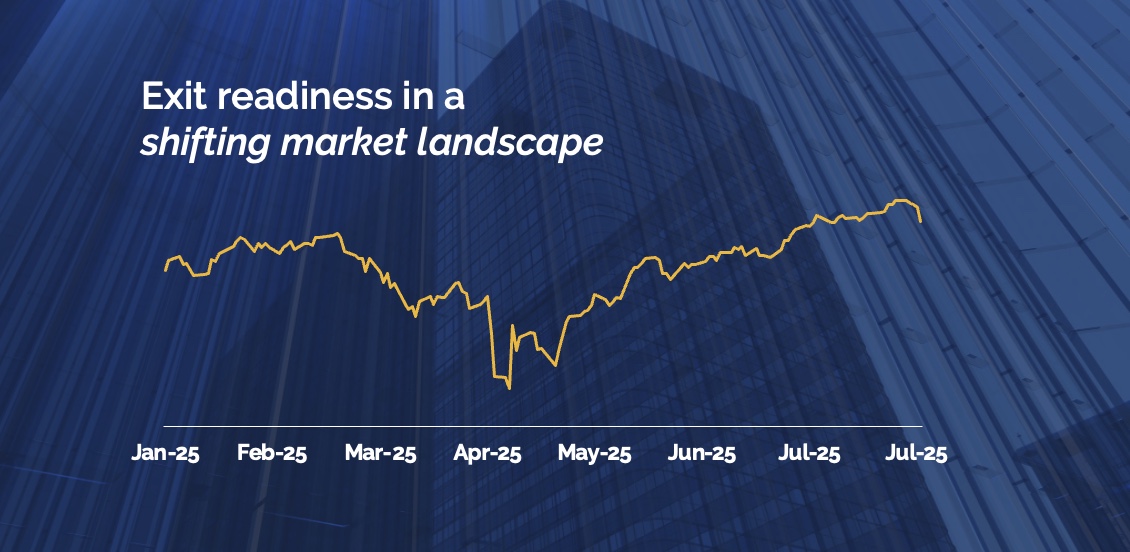

By focusing on exit preparations, leading GPs are taking control of portfolio liquidity early by positively impacting the perception of potential investors.

This document explains how Accellency’s Equity Story for Exit Readiness (ESTEXTM) methodology can benefit buyout GPs and their portfolio companies.

Download here to learn more: