Uncertainty is the only certainty in markets today. The result is that managers, owners and their advisors may need to be exit ready for longer periods of time, so they can take advantage of shorter windows of liquidity.

Despite some positive signs, both the M&A and IPO markets have so far failed to deliver the significant recovery many market participants were hoping for this year. As usual, uncertainty is to blame. And – as usual – we seek comfort in the perennial fact that “the pipeline remains strong”.

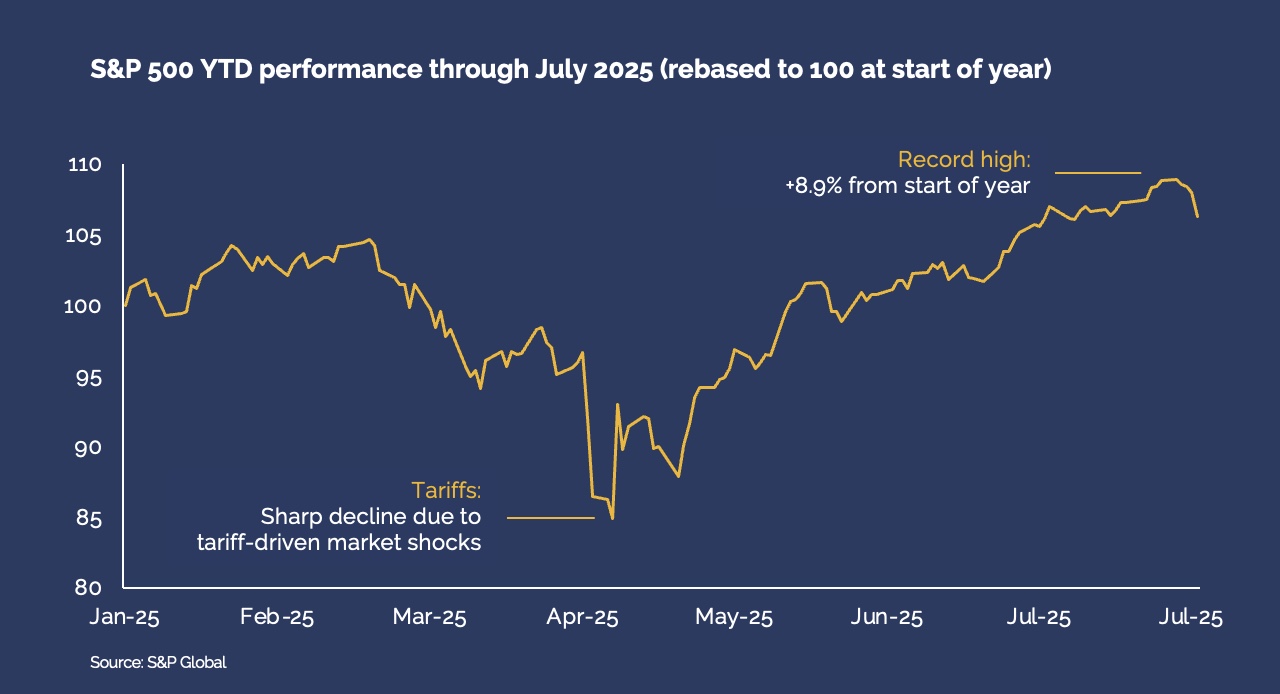

Last week, tariffs shot back to the top of the agenda. This brought more volatility and broke a long run of record highs in equity markets after their strong recovery from the very sharp dips in Q2.

Exit optimism has been building for the post-summer window. But optimism is fragile and easily shaken.

Most likely, uncertainty will continue to stalk markets. Prolonged benign periods like the early 2000s or the pre-Covid, near-zero-rate world are unlikely to return soon. Whether it’s the unstable geopolitical situation, fears over sustainability of government debt, tariff talk or something else entirely, it’s difficult to foresee very long periods of stability.

If uncertainty is the only certainty, then planning for capital market events may require a new approach.

Contact us if you want to discuss how equity stories can boost the valuation of your portfolio companies and get them exit ready in a competitive M&A environment: https://www.accellency.eu/contact-us/

You can read more about Accellency’s Equity Story for Exit Readiness (ESTEX®) methodology here: https://www.accellency.eu/publication/equity-stories-a-critical-tool-for-exit-readiness/