Accellency shares expert insights at France Invest IR Breakfast Event

Accellency had the pleasure of being a key speaker at France Invest IR Breakfast, where we presented our perspective on the evolving role of Investor Relations, shared our systematic 8-step positioning approach, and outlined the key principles to maximise fundraising and LP engagement. Our key takeaways from the session: – GPs must strengthen their differentiation […]

Equity market volatility – an investor relations opportunity

Recent equity market volatility presents an investor relations opportunity for the many overlooked listed companies, particularly in unloved sectors & regions. Volatility is inevitable as markets grapple with the difficult challenge of valuing AI. This requires staggering levels of investment with the potential for transformational impact. The range of possible outcomes is extremely wide and […]

Equity Story for Exit Readiness in Infrastructure: Resilience or Growth?

When preparing to exit an infrastructure asset, one question should be systematically addressed : is the equity story about resilience and yield or growth ? While investors typically turn to infrastructure assets for resilience and yield, the reality is that valuation is equally driven by growth potential, as almost all infrastructure projects become multidimensional, digitalised […]

What do GPs need to know about Total Portfolio Approach (TPA) investing?

This week, CalPERS became the first US pension fund to adopt TPA as an investment model, replacing the Strategic Asset Allocation (SAA) model which still dominates the industry. TPA advocates argue that this more flexible approach delivers higher returns for the same amount of risk. Liability-driven asset owners are constrained by their obligations, so the practical […]

Private Credit: now more than ever, GPs need to stand out

Everybody’s talking about private credit. It’s making big headlines and unsettling some market participants — yet the overall quality of the asset class remains strong, and demand continues to grow. This creates significant opportunities for GPs who can win the confidence of LPs. Fundraising reached record levels in the first 9 months of 2025 while […]

Buyout outlook brightens!

The outlook for the buyout industry looks a lot healthier than you might think. Despite the negative commentary around deal volume, exits and fundraising, we see good reasons to be positive. Reality looks a lot better than the headlines suggest. 2026 could well be the year of positive surprises in the buyout industry.

Accellency at IPEM!

Sentiment at last week’s IPEM conference in Paris was a lot more positive than in the past few years. Diaries were noticeably busier at Europe’s flagship gathering for private markets professionals, with many GPs and LPs filling their schedules right up to the end of Friday afternoon. Now that everyone has come to terms with […]

Quarterly reporting – a presidential challenge

Quarterly reporting – a presidential challengeIt’s not every day that the world’s most powerful person takes a keen interest in… financial reporting. This week, President Trump reiterated his view that US listed companies should move from quarterly to 6-monthly financial reporting to “save money and allow managers to focus on properly running their companies”. This […]

IPOs are back!

IPOs are back. 7 companies are expected to list in New York this week.

Many IPO processes were postponed by economic uncertainty and market volatility earlier in the year, resulting in an exceptionally active September pipeline. So far, the market has shown a strong appetite to absorb these new listings.

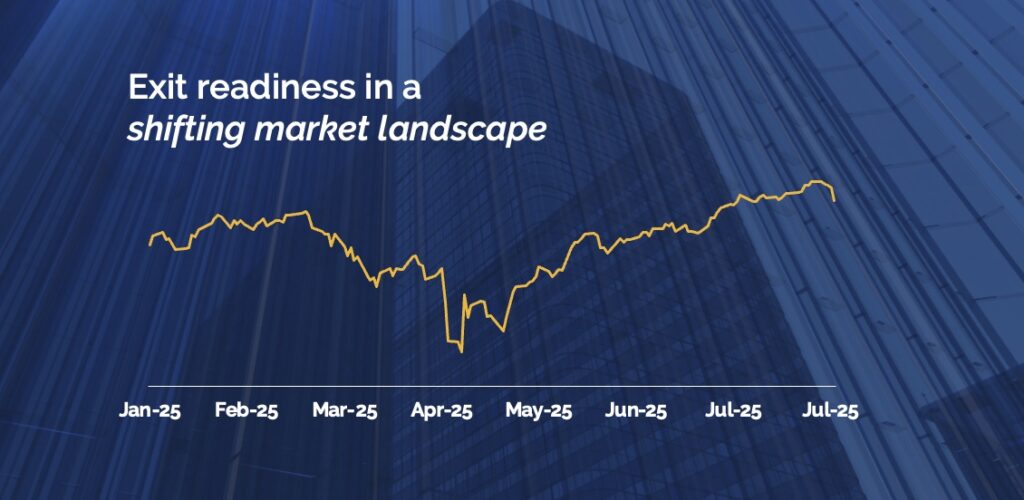

Exit Readiness In A

Shifting Market Landscape

Uncertainty is the only certainty in markets today. The result is that managers, owners and their advisors may need to be exit ready for longer periods of time, so they can take advantage of shorter windows of liquidity.